Responsible Investments

Portfolio Overview

We maintain a conservative risk profile in our asset management strategy, with allocations primarily in fixed income securities (80 %), equities (10 %), and real estate (10 %). The majority of our assets are managed externally, either through discretionary mandates or investment funds. Our asset management approach integrates environmental, social, and governance (ESG) considerations, in line with our principles for responsible investment.

Responsible Asset Management

Fremtind’s asset management is governed by internal guidelines designed to ensure we act as a responsible investor and owner. Sustainability is embedded in our investment and management processes, and our work is guided by internationally recognized principles for responsible investment. ESG assessments are considered alongside traditional financial metrics in our investment decisions. We believe that long-term value creation is closely linked to responsible operations and sound corporate governance. Therefore, we are confident that integrating sustainability considerations contributes to strong risk-adjusted returns.

To achieve our sustainability goals, we apply three main instruments in our investment portfolio:

- Exclusions: We exclude product categories, countries, and companies that violate our guidelines.

- ESG Integration: We incorporate sustainability factors into our investment analyses and decision-making processes.

- Active Ownership: Our greatest potential for influence lies in active ownership, primarily through collaboration with external asset managers to engage with companies in our fund holdings.

Key Points:

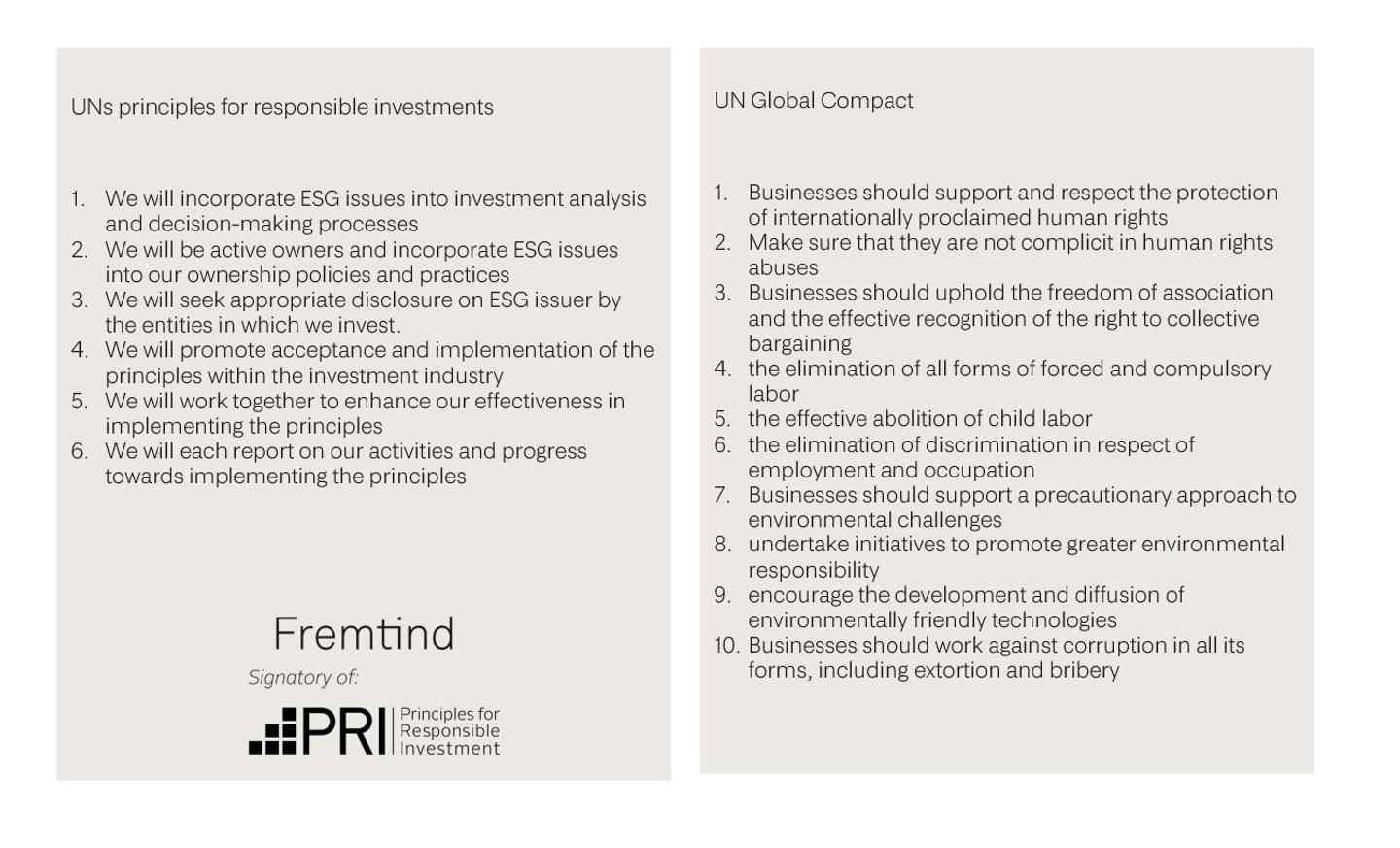

- Our asset management is based on the UN Global Compact principles, covering human rights, labour standards, environmental protection, and anti-corruption.

- Fremtind is a signatory to the UN Principles for Responsible Investment (UN PRI).

- We support the Paris Agreement’s goal of net-zero emissions by 2050, with short-, medium-, and long-term targets embedded in our investment strategy.

- We are a member of Norsif (Norwegian Forum for Responsible and Sustainable Investment), supporting the development of responsible investment as a professional field in Norway.

- We require full transparency across all funds and use third-party data providers to ensure compliance with our investment guidelines.

UNs principles for responsible investments.

Our Commitment to the Paris Agreement

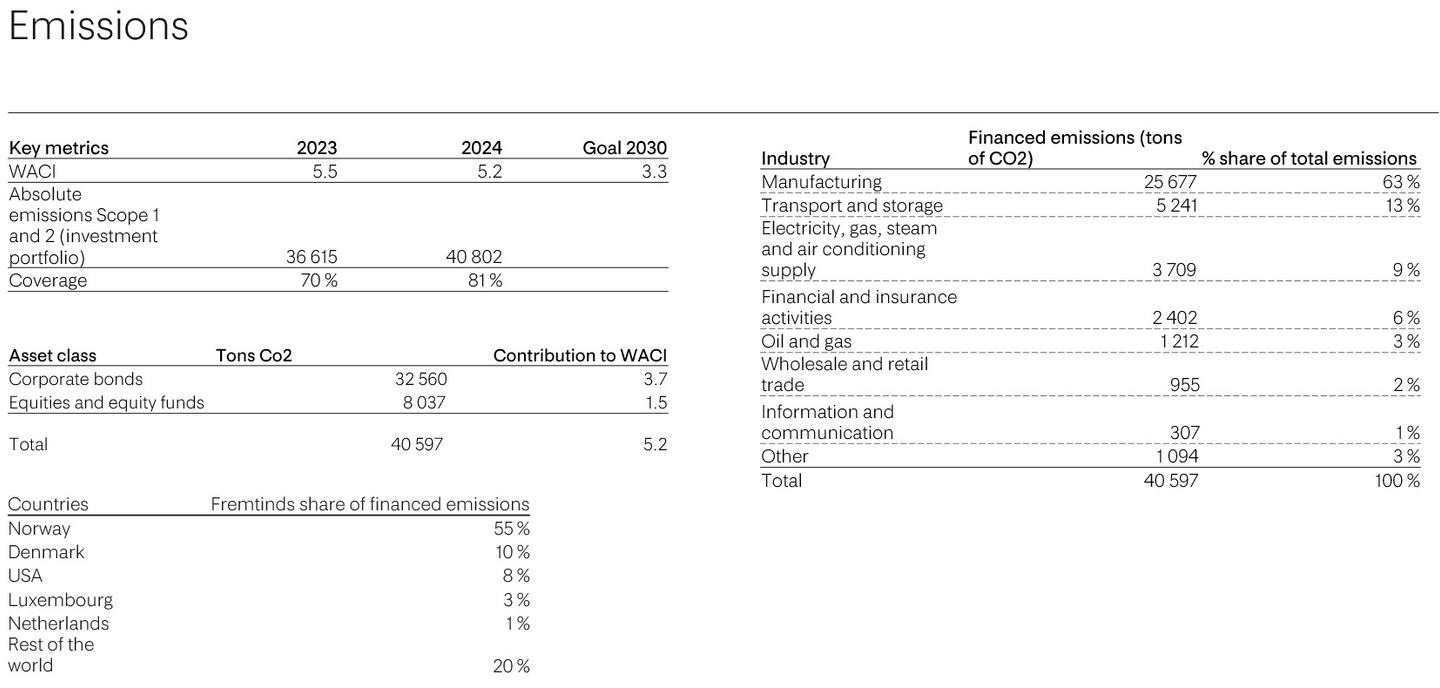

We support the Paris Agreement’s target of net-zero emissions by 2050 through our investment portfolio. To achieve this, we have established a set of targets and guidelines aimed at limiting global warming to well below 2°C. We have also set 2030 targets to enable timely implementation and measurable short-term results.

To ensure progress toward net-zero, we have set a 2030 interim target to reduce the portfolio’s emissions intensity. Our asset management aims to reduce emissions intensity by 40 % by 2030, using 2023 as the baseline. We apply the Weighted Average Carbon Intensity (WACI) metric, which measures tonnes of CO₂e per NOK in revenue for both direct and indirect listed investments. Our real estate investments have separate short- and medium-term targets.

Read more in Fremtind’s transition planEkstern lenke

Real Estate Portfolio

A portion of our investment portfolio is allocated to real estate, primarily through direct investments. Fremtind Eiendom (Eng. Fremtind Real Estate) adheres to our responsible investment guidelines and meets strict requirements for socially responsible supplier conduct. For more information on our supply chain practices, see fremtind.no/åpenhetsloven.

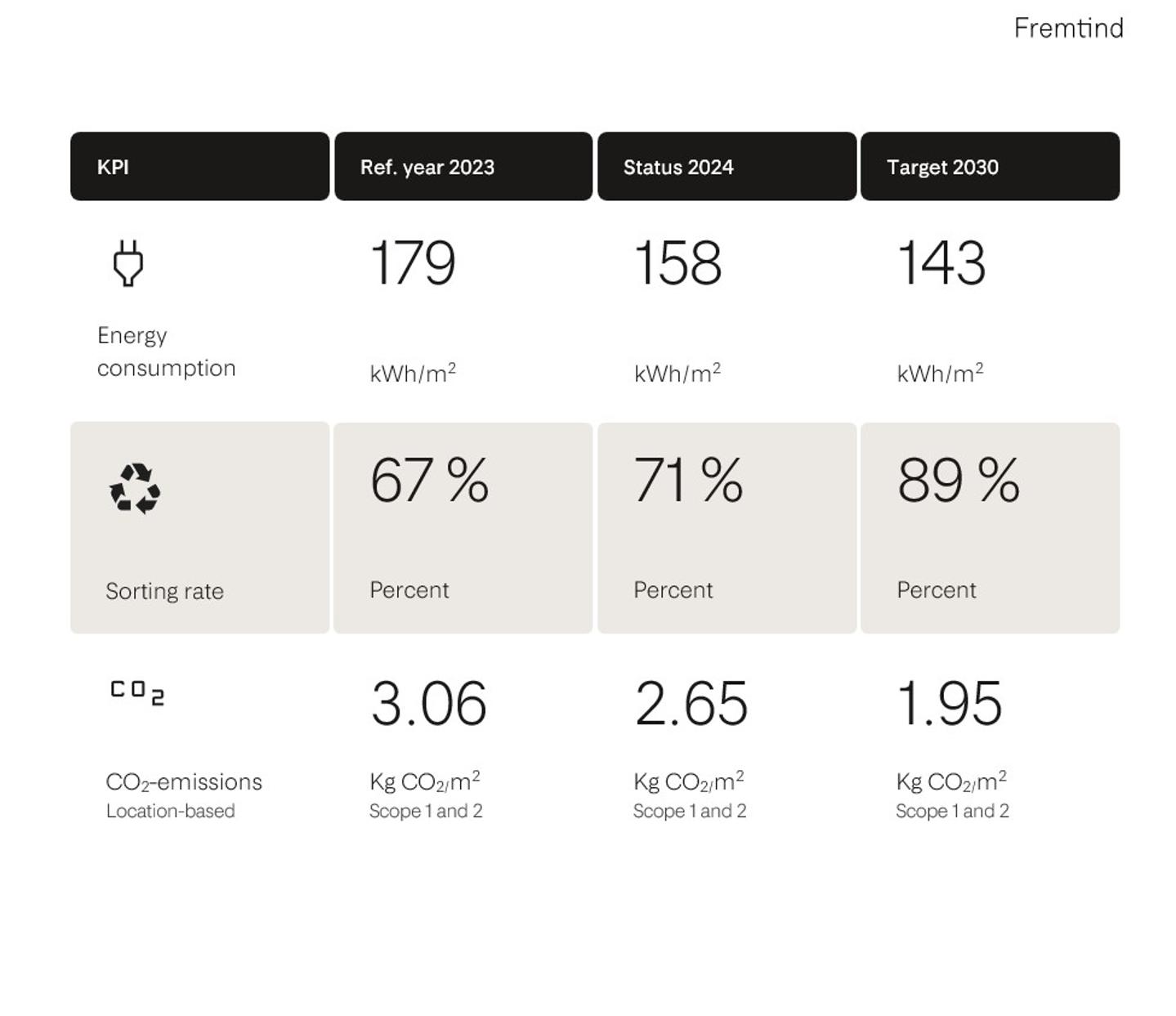

We have set emissions targets for the real estate portfolio, aligned with the broader investment strategy. We continuously work to improve environmental performance by reducing greenhouse gas emissions, lowering energy consumption, and increasing waste sorting rates. We also maintain our ISO 14001 certification.

A table summarizing the real estate portfolio’s 2024 status, with reference to 2023 and targets for 2030, is available in Fremtind’s transition plan.Ekstern lenke

Governing Documents

- Guidelines for Responsible Investments in Fremtind’s Asset Management

- Stewardship and Voting Instructions

- ESG Position Paper – Our Expectations

These documents are available in the sustainability library.

Active Ownership in Practice

We aim to influence companies in our portfolio toward more sustainable practices. Our active ownership is guided by the UN PRI and UN Global Compact principles. Fremtind primarily invests through external managers via funds or discretionary mandates. These managers, with whom we maintain regular dialogue, demonstrate close engagement with portfolio companies. All managers priorities sustainability and are signatories to the UN PRI.

We hold direct ownership of a smaller portion of our equity portfolio, where we exercise voting rights as part of our active ownership strategy. Read more in our “Stewardship and Voting Instructions” document.

One of our active ownership goals is to engage with all external managers at least once annually on relevant sustainability topics. In 2024, we held such discussions with all managers.

Exclusion Criteria

Fremtind avoids exposure to companies involved in serious breaches of widely accepted norms for business conduct, as this conflicts with our view of responsible asset management. We primarily follow the guidelines of the Norwegian Council on Ethics and use the exclusion list of the Government Pension Fund Global (GPFG) as a reference for listed equities and bonds. Our follow-up practices vary depending on whether ownership is direct or indirect, as some of our managers apply stricter exclusion criteria than the GPFG.

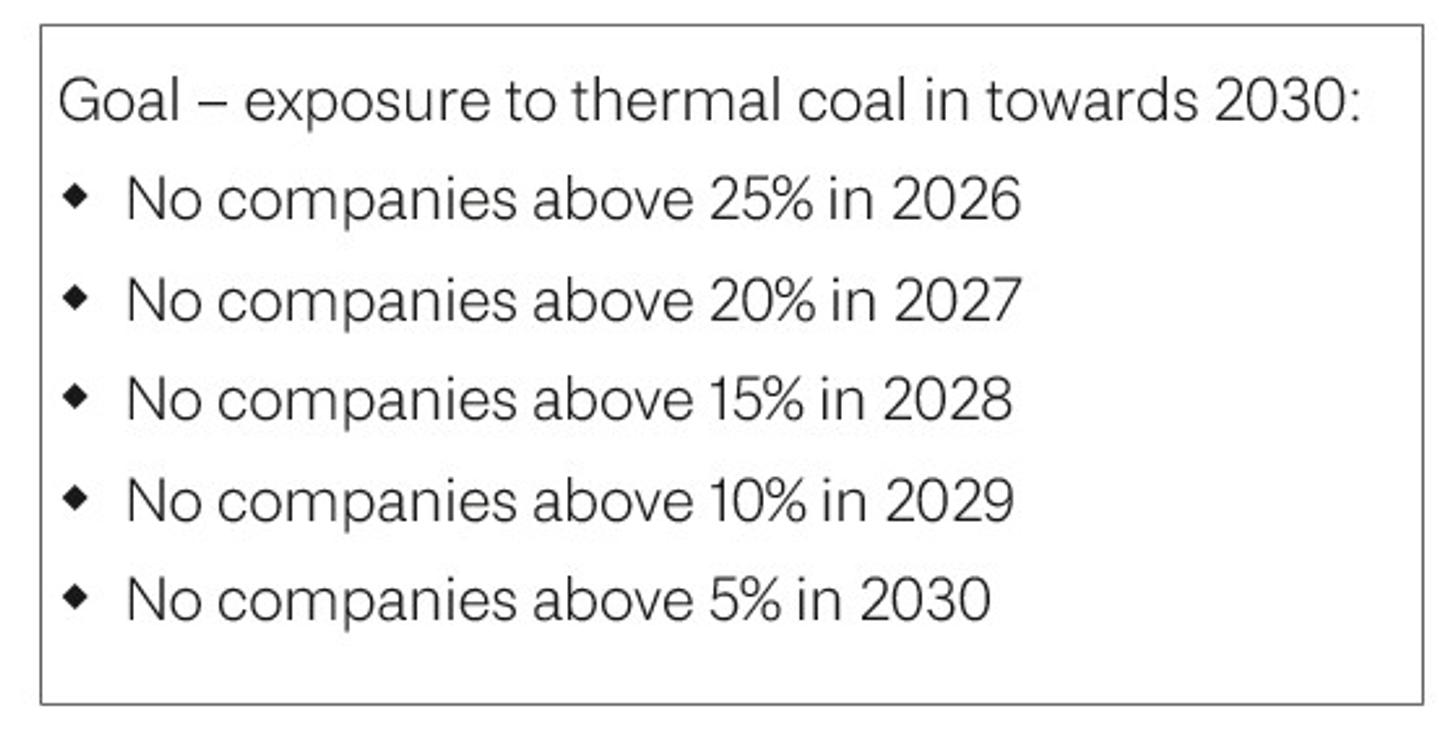

We do not invest in certain product categories or countries. For example, we exclude mining and energy companies that derive 30 % or more of their revenue or operations from thermal coal. We also exclude companies producing components for weapons that violate fundamental humanitarian principles, as well as the tobacco sector. Countries on the UN sanction list such as Syria, North Korea, Russia, and Belarus are excluded from our investment universe.

Read more about our approach to exclusions and active ownership in the Guidelines for Responsible Investments.

Our ESG Position Paper outlines our expectations for companies regarding environmental and social impacts. The investment portfolio targets net-zero emissions by 2050, including companies exposed to coal and unconventional oil and gas.

Goal - exposure to thermal coal in towards 2030.

Data breakdown.

Environmental targets real estate portfolio.